Roughly two months ago on April 11, the stablecoin economy was valued at $190 billion and was getting closer to surpassing $200 billion in value. However, after the Terra stablecoin fallout, the fiat-pegged token economy lost $16.31 billion in value since then. While that value was erased from the stablecoin market, stablecoins themselves represented 9.35% of the entire crypto economy’s net U.S. dollar value at the time. 61 days later, the crypto economy is worth roughly $1.15 trillion and the stablecoin economy represents 13.8% of that total today.

In 61 Days, Stablecoin Dominance Swelled From 9% to 13.8%

For the first time in history, three stablecoins were top ten digital currencies in terms of market valuation 36 days ago on May 6, 2022. At the time, it was tether (USDT), usd coin (USDC) and terrausd (UST), but that was before the UST implosion.

While terrausd is gone, there’s still three stablecoins in the top ten today, as binance usd (BUSD) is the seventh-largest crypto asset as far as market cap is concerned. Two months ago on April 11, the stablecoin economy was valued at $190 billion but today, the valuation of the stablecoin market is now $159 billion.

On that day in April, the entire crypto economy was valued at $2.03 trillion and today it’s worth roughly $1.15 trillion. Even though Terra’s UST fallout saw billions leave the stablecoin economy, it dominates by a lot more than it did when it was nearing $200 billion.

Stablecoins account for whole lot of trade volume as well, and at the time of writing, fiat-pegged tokens have seen $46.1 billion in trade volume, while all the crypto assets combined saw $71.6 billion. The data shows that 64.38% of all the digital currency trades today are swapped against stablecoin pairs.

For instance, tether (USDT) trades account for 60.26% of bitcoin’s (BTC) global trade volume while BUSD commands 10.05%. USDT and BUSD are BTC’s top two trading pairs at the time of writing, according to cryptocompare.com metrics.

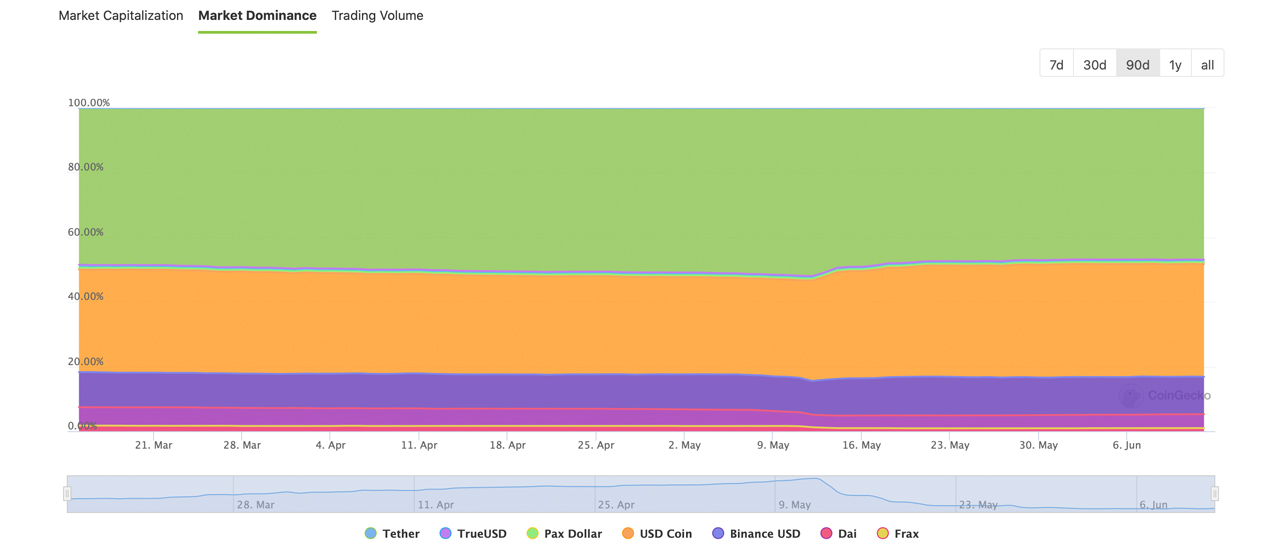

Tether (USDT) is still the king of stablecoins with an $72 billion market valuation that represents more than 6% of the entire crypto economy. Usd coin (USDC) is the second-largest stablecoin by market cap with $53.7 billion in value.

USDC dominates today by more than 4% of the crypto economy and combined both USDC and USDT make up 76.92% of the entire stablecoin dominance of 13.40%. BUSD meanwhile, represents 1.58% of the entire crypto economy. That leaves a little more than 1% of the crypto economy that stem from stablecoins like DAI, FRAX, TUSD, and USDP.

What do you think about the stablecoin economy representing 13.8% of the entire crypto economy? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments are closed.