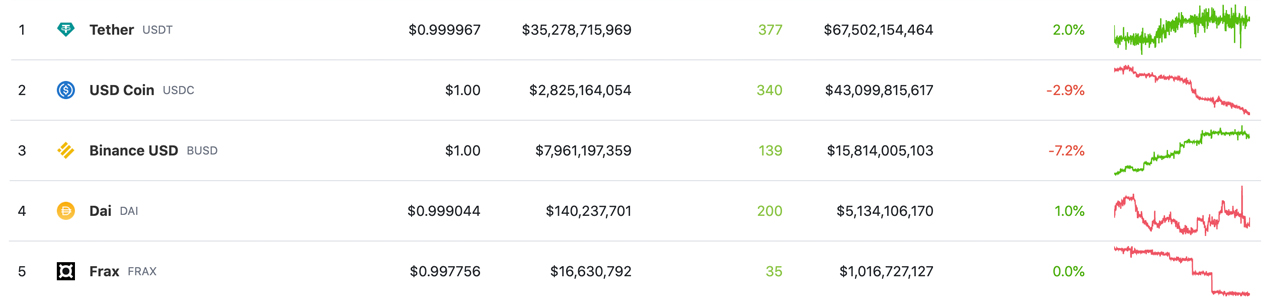

The stablecoin economy continues to deplete as more than $3 billion has been erased from the stablecoin market ecosystem over the last 44 days. While statistics show that tether’s market valuation has risen by 2% over the last 30 days, usd coin’s market cap slid by 2.9%, BUSD valuation shed 7.2% over the last month and gemini dollar’s market capitalization slid by 1.5%.

$3 Billion in Dollar-Pegged Tokens Erased in 44 Days as Stablecoin Swaps Represent Nearly 80% of Global Crypto Trade Volume

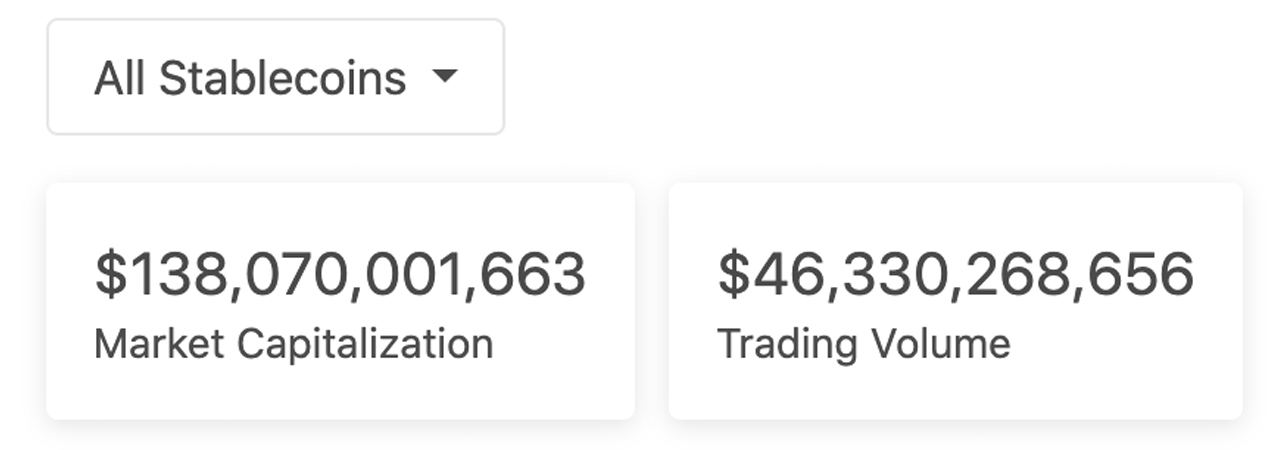

The overall value of the top stablecoins by market capitalization has shed roughly $3 billion during the last 44 days or since Dec. 15, 2022. At that time, the stablecoin economy was worth $141.07 billion. On that day, stablecoin swaps represented $44.55 billion of the $53.91 billion in global trade volume.

After losing more than $3 billion, the stablecoin economy is valued at $138.07 billion, and stablecoin trades equate to $46.33 billion of the $58.76 billion in global trades on Jan. 28, 2023. Out of the top ten stablecoin assets, three market capitalizations have lost value during the last 30 days.

Statistics show that usd coin (USDC) has shed 2.9% in the past month, and BUSD lost the most with a 7.2% reduction in 30 days. The Binance-affiliated and Paxos-managed dollar-pegged token BUSD has seen a significant number of redemptions over the last few months. At the time of writing, BUSD’s overall market cap in U.S. dollar value is $15.8 billion.

USDC’s market capitalization on Saturday is around $43 billion. On Dec. 15, 2022, the valuation was around $45 billion. Similarly, gemini dollar’s (GUSD) market cap was around $591 million 44 days ago, and today it is around $571 million. While there were a few stablecoin projects that saw market capitalizations slide, tether, DAI, trueusd (TUSD), and pax dollar (USDP) saw increases.

Tether (USDT) saw a 2% increase in coins in circulation over the last 30 days. Makerdao’s DAI increased by 1%, and trueusd (TUSD) climbed 25.3% higher. Pax dollar (USDP) rose by 5.1% and Tron’s USDD saw a small increase of around 0.6% over the last 30 days. Liquity usd (LUSD) managed to rise by 24.4% over the past month, and Abracadabra’s stablecoin MIM jumped 3.9%.

While tens of billions in stablecoin assets have been removed since last year, they still represent a dominant force in the crypto economy. Since May 2022, three stablecoin assets have remained in the top ten market cap positions: USDT, USDC, and BUSD. Both USDT and USDC have been in the top ten positions for much longer.

Furthermore, the entire stablecoin economy, valued at $138 billion, represents 12.71% of the entire crypto economy’s value of $1 trillion. In trade volume alone on Saturday, Jan. 28, stablecoins equated to 78.85% of all crypto asset trades worldwide on both centralized and decentralized exchange (dex) platforms. That means more than seven out of ten crypto asset trades today, have been swapped with a stablecoin.

What does the recent decline in the stablecoin economy signify for the overall cryptocurrency market? Share your thoughts in the comments.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments are closed.