Tron’s stablecoin market capitalization has grown by more than 8% in the last seven days, crossing the $40 billion mark, according to DeFillama data.

Over the past week, the Tron network witnessed a massive inflow of more than $1 billion on March 12 and $917.49 million on March 17, according to DeFillama data.

Tether USDT Dominates TRON

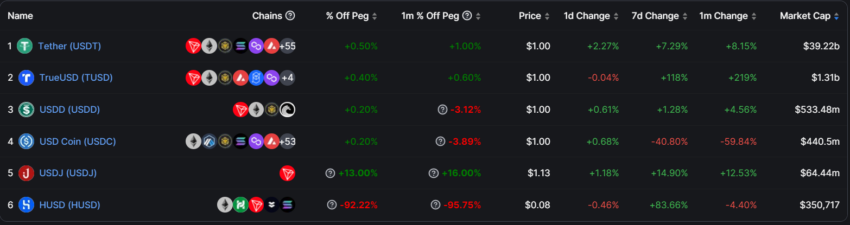

Tether USDT dominates 94.36% of the total stablecoins on Tron. USDT has a market cap of 39.26 billion after increasing by 8.26% in the past 30 days.

The high-flying TrueUSD (TUSD) stablecoin has grown its supply massively during the past week. According to DeFillama data, TUSD supply increased by 118% to $1.31 billion — making it the second-largest stablecoin on the network.

Meanwhile, TUSD’s total stablecoin supply recently crossed the $2 billion mark. The stablecoin is one of the biggest gainers from the recent issues plaguing rivals like Binance USD (BUSD) and USD Coin (USDC).

The Tron-based algorithmic stablecoin USDD is the third prominent stablecoin on the network. USDD has a market cap of $534.01 million after rising by 5% in the past month.

On the other hand, USDC’s recent depeg significantly affected its supply on the Tron network. The Circle-issued stablecoin declined roughly 60% in the last 30 days to $440.5 million. Other stablecoins on the network include USDJ and HUSD.

Justin Sun Eyes $60B

Tron founder Justin Sun said the blockchain network wants to grow its stablecoin market cap to $60 billion before the end of the year.

In a March 17 Twitter thread, Sun said the blockchain was working to improve its infrastructure to achieve this growth. According to him, the network is “innovating” so that users can have a “secure, reliable, and efficient platform to conduct their transactions.”

Speaking on the current issues bedeviling the industry, Sun noted that the crypto market had had its fair share of challenges in the current year. But his team is committed to growing the five stablecoins on its network.

“Despite the challenges ahead, we are excited to play our part in nurturing the global stablecoin market, contributing to the development of DeFi, and shaping the future of finance,” he added.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Comments are closed.