Grayscale’s recently launched Bitcoin ETF, GBTC, is witnessing a gradual decline in outflows, as around $5 billion in digital assets are withdrawn from the fund.

Despite the substantial outflows, market analysts express optimism that the worst may be over. This sentiment suggests a potential positive shift in Bitcoin’s price performance.

Bitcoin Outflows Slow Down

In the wake of the US Securities and Exchange Commission’s (SEC) recent approval of several spot Bitcoin ETFs, Bitcoin experienced a notable 20% decline. Significant outflows from Grayscale primarily fueled this downturn.

Analysts attribute the substantial outflows to profit-taking maneuvers by investors previously exposed to the fund’s discount. Additionally, there were indications that some traders were reallocating their investments away from GBTC due to its comparatively high fee.

GBTC currently charges a 1.5% fee, while competing ETFs such as BlackRock’s IBIT have fees under 1%.

These factors played a pivotal role in the initial surge of outflows from the fund. However, recent trends indicate a slowdown, with $255 million withdrawn on the eleventh day of trading, the lowest GBTC outflow since the first day of trading. Still, the total outflows from the fund are over $5 billion, according to BitMEX Research.

Concurrently, the sell-off has led to a substantial reduction in Grayscale’s Bitcoin balance, which now stands at over 508,000 BTC, valued at $21 billion, according to Arkham Intelligence. It is worth noting that since the launch of spot Bitcoin ETFs, the fund has deposited 113,129 BTC into Coinbase, equivalent to $4.6 billion.

BTC Price Will Recover

Market analysts interpret the decline in GBTC outflows as a positive indicator of Bitcoin’s price trajectory.

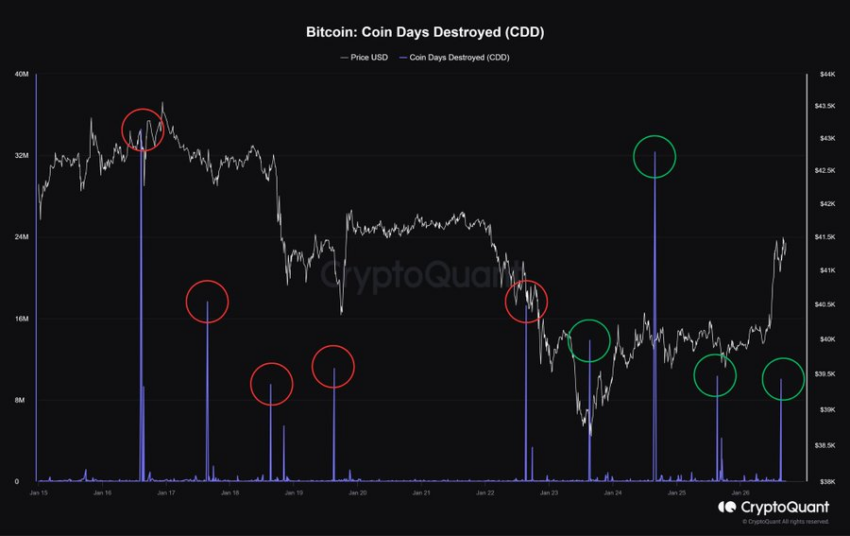

For instance, JA Maartun recently shared a chart illustrating the diminishing impact of Grayscale on BTC prices. Despite the sell-off, Bitcoin’s value not only remained stable but also demonstrated an impressive increase.

“All selling pressure from Grayscale was absorbed and the price even managed to increase, which is impressive,” Maartun said.

Another analyst, Ted, dismissed the narrative around GBTC selling as excessively sensationalized. His analysis revealed that the influx of Bitcoin into the market through nine new spot BTC ETFs surpassed the outflow from GBTC by over 120,000 BTC in the last 90 days.

In contrast, Resdegen highlighted Bitcoin’s resilience in trading above $41,000 despite the various selling pressures. The analyst pointed out significant factors, such as GBTC’s substantial outflow, the US government announcement of selling $130 million worth of seized BTC, and Celsius’ movement of $1 billion in ETH, which seemingly had no adverse impact on the top cryptocurrency price.

Anticipating bullish signals on the horizon, Resdegen emphasized the potential for bears to face significant challenges, particularly with the upcoming BTC halving event.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Comments are closed.