Crypto investment inflows surged to $2.2 billion last week, the highest since July 2023. Experts ascribe this growth to mounting optimism over a potential Republican win in the upcoming US elections.

This shift in political expectations has boosted both investor confidence and market prices.

Crypto Inflows at Multi-Month Highs Amid US Election Buzz

After recording $407 million in positive flows for the week ending October 11, digital asset investment inflows reached 2.2 billion last week. This represents a five times growth week-over-week, with Bitcoin seeing the largest inflows at $2.13 billion.

Positive flows into Ethereum reached $57.5 million. Meanwhile, multi-asset inflows interrupted their 17 consecutive week inflow streak to record $5.3 million in outflows.

Like the week before, CoinShares analysts ascribe the growing interest to the upcoming US elections, given that the US led the charge with inflows totaling $2.3 billion.

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum,” a paragraph in the report read.

Read more: How Can Blockchain Be Used for Voting in 2024?

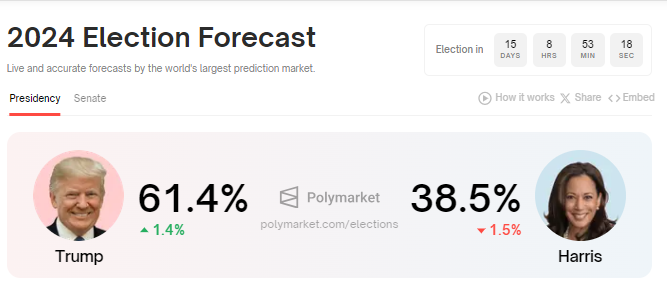

According to CoinShares researchers, this highlights a growing interest in crypto investments within the country. It comes as the US election countdown continues, with only 15 days left. According to Polymarket, pro-crypto candidate Donald Trump is in the lead with a 22.9 percentage point difference against Kamala Harris.

With the Republican candidate generally perceived as being supportive of the cryptocurrency sector, the general sentiment is a potential Donald Trump victory could lead to more crypto-friendly regulations.

As BeInCrypto reported, the Republican presidential aspirant has plans to overhaul US crypto rules beyond Gary Gensler. This would fuel market growth further amidst beliefs that the party may introduce policies beneficial to the cryptocurrency industry.

As the countdown continues, investor interest in crypto is also growing. The report indicated a 30% increase in trading volumes in digital asset investment products last week. The uptick in trading activity, combined with rising asset prices, has brought total assets under management (AUM) in the digital asset space to nearly $100 billion.

If the current momentum continues, the market could soon cross this milestone. Crypto investment inflows could also increase this week compared to last week.

“A positive regulatory environment could open the floodgates for institutional investment. If the US sees a leadership shift that’s supportive of crypto innovation, it could lead to clear guidelines for crypto businesses, a potential green light for ETFs, and institutional confidence, leading to a wave of new capital into crypto markets,” an analyst wrote on X (formerly Twitter).

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Meanwhile, BeInCrypto data shows Bitcoin is eying the $70,000 psychological level, trading for $68,210 as of this writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Comments are closed.