BQX and CRV have the potential for an increase towards the closest resistance area, while HEDG has yet to break out above long-term resistance. AVAX is already at an all-time high following a parabolic support line, making its position the most precarious out of the five altcoins.

Biggest Altcoin Movers

During the week of Jan 11-18, the five altcoins that increased the most were:

HedgeTrade (HEDG) – 275%

Voyager Token (BQX) – 162%

Curve Dao Token (CRV) – 154%

IOST (IOST) – 147%

Avalanche (AVAX) – 133%

HEDG

HEDG has been following a descending resistance line since reaching a high of $3.15 on June 4, 2020. HEDG has validated the line multiple times up to this point, most recently on Jan. 16, during last week’s upward movement.

Despite the significant increase, HEDG failed to break out above this line, merely validating the $2.85 area as resistance once more. Currently, HEDG is back to trading below this descending resistance line.

While technical indicators in the daily time-frame are still bullish, the long upper wick and failure to break out is a strong sign of selling pressure.

Therefore, it’s possible that HEDG drops to the 0.618 Fib retracement level before potentially making another breakout attempt.

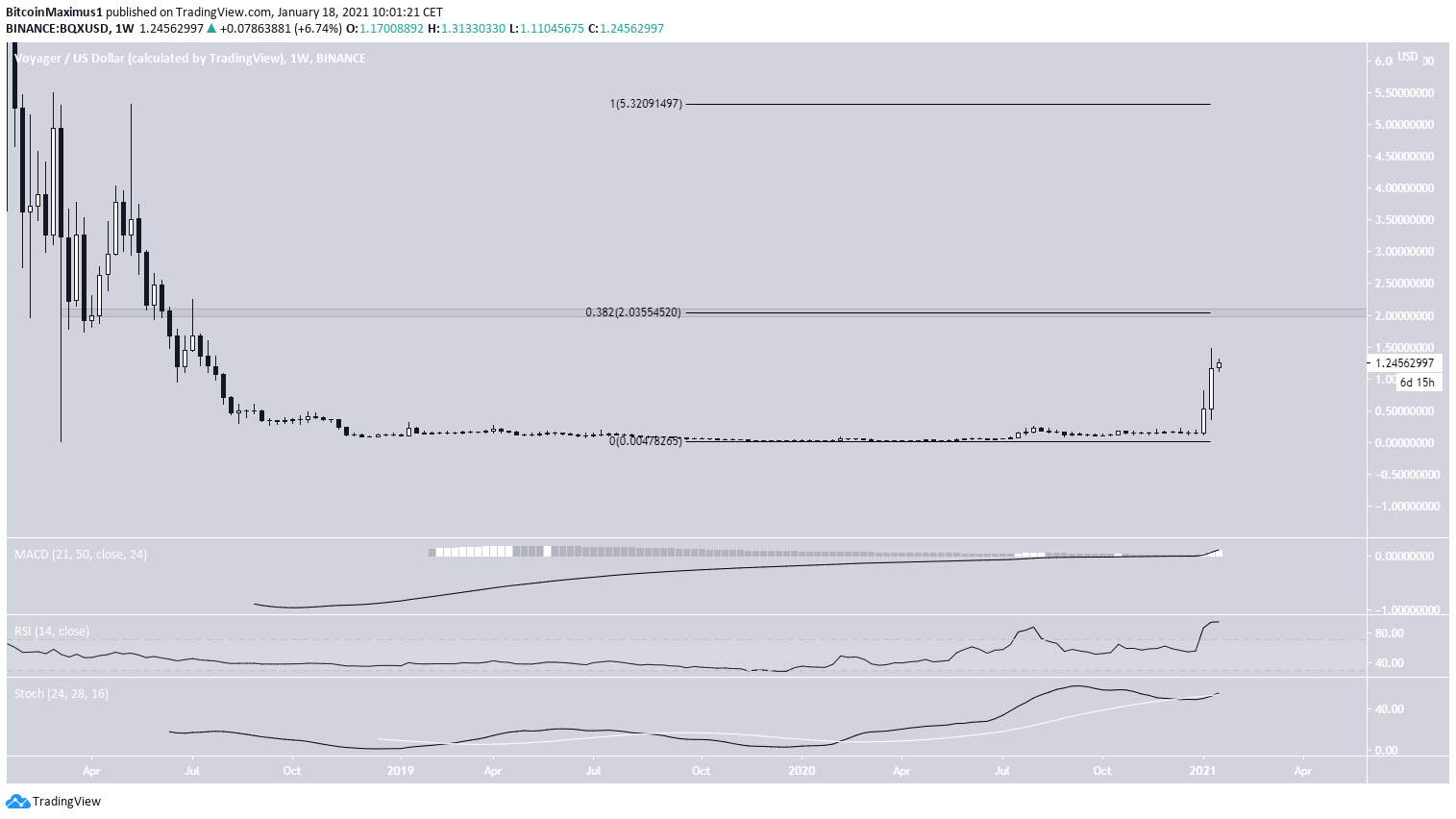

BQX

Beginning on Jan. 4, BQX has had a massive run-up, increasing by 933% in the process.

Despite such a considerable upward move, there is no weakness in technical indicators yet, despite all of them signaling that prices are in the overbought territory.

The weekly chart also suggests that there is room for further increases. The closest resistance area is found at $2.03 (0.382 Fib retracement level).

Weekly indicators are similarly overbought but bullish, supporting the continuation of the upward movement.

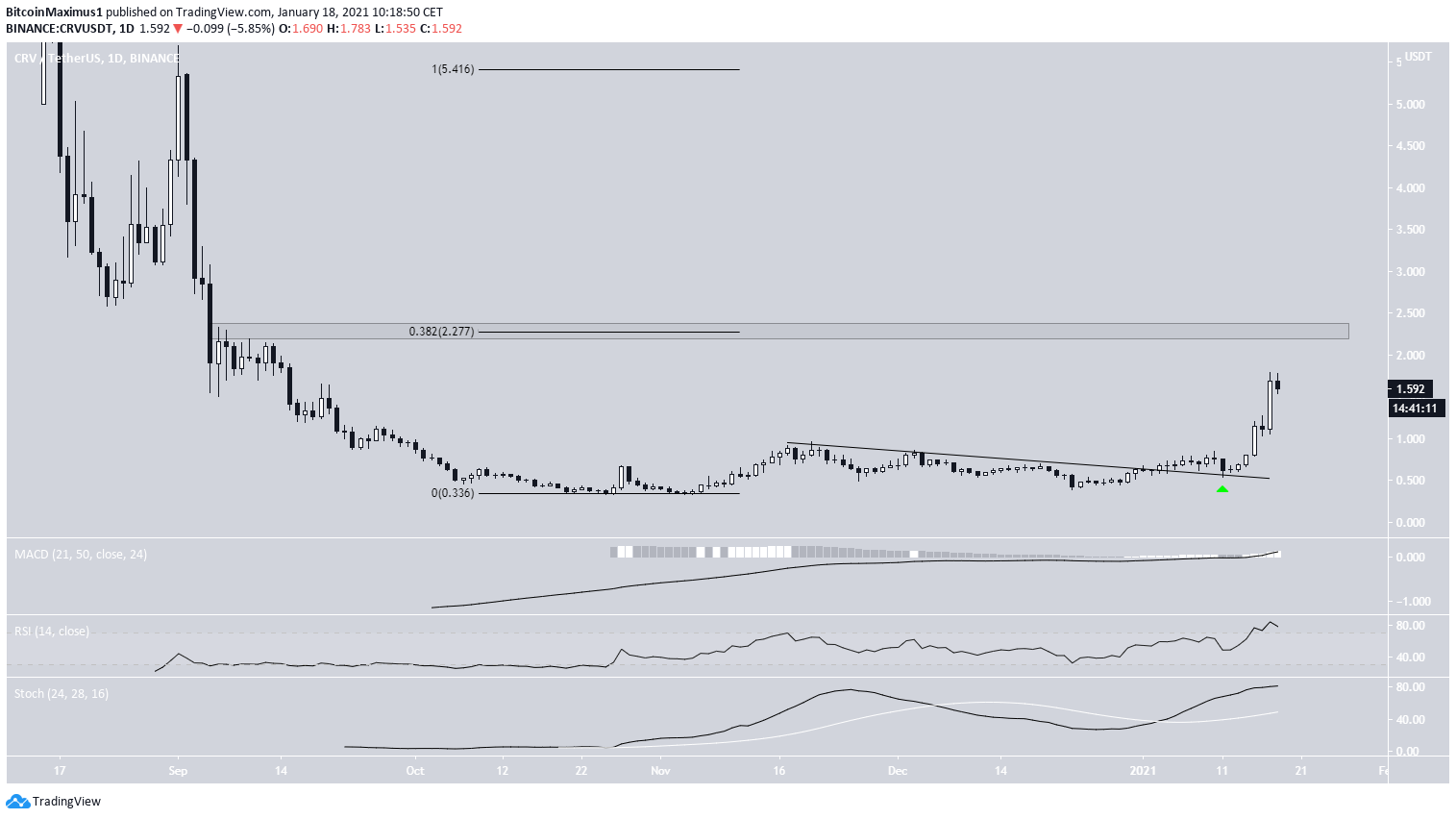

CRV

CRV has been increasing rapidly since breaking out from a descending resistance line and validating it as support on Jan. 11.

Despite the parabolic rate of increase, technical indicators are still bullish, though they are in overbought territory.

The closest resistance area is found at $2.27 (0.382 Fib retracement level). Similar to BQX, CRV is expected to reach this resistance.

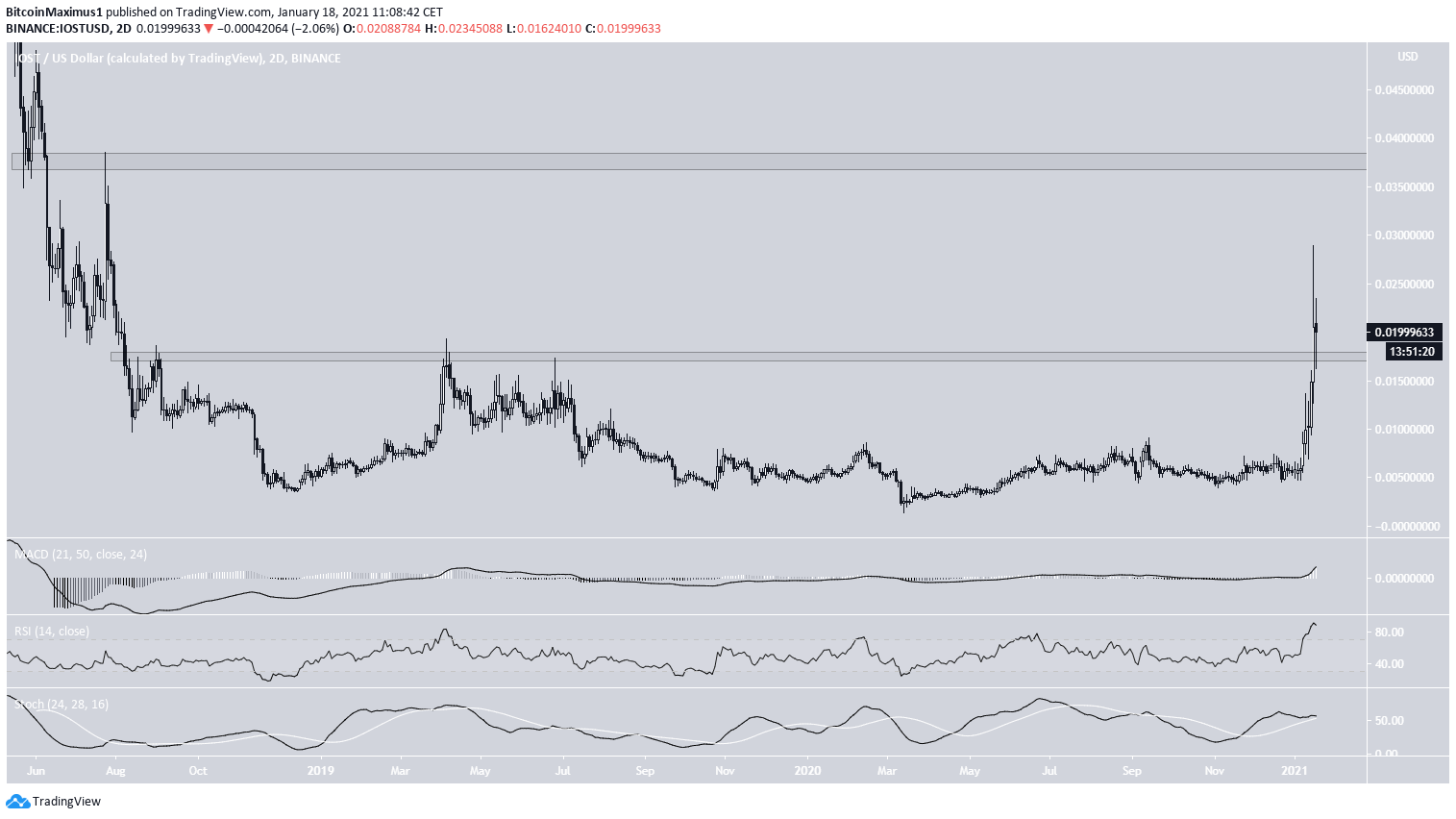

IOST

On Jan. 15, IOST reclaimed the $0.0175 area, which had previously acted as resistance since the beginning of 2018. IOST validated the area as support after and has been increasing since.

Technical indicators are still bullish, despite being overbought, supporting the continuation of the upward movement.

Therefore, IOST is expected to continue increasing towards the closest resistance area at $0.037.

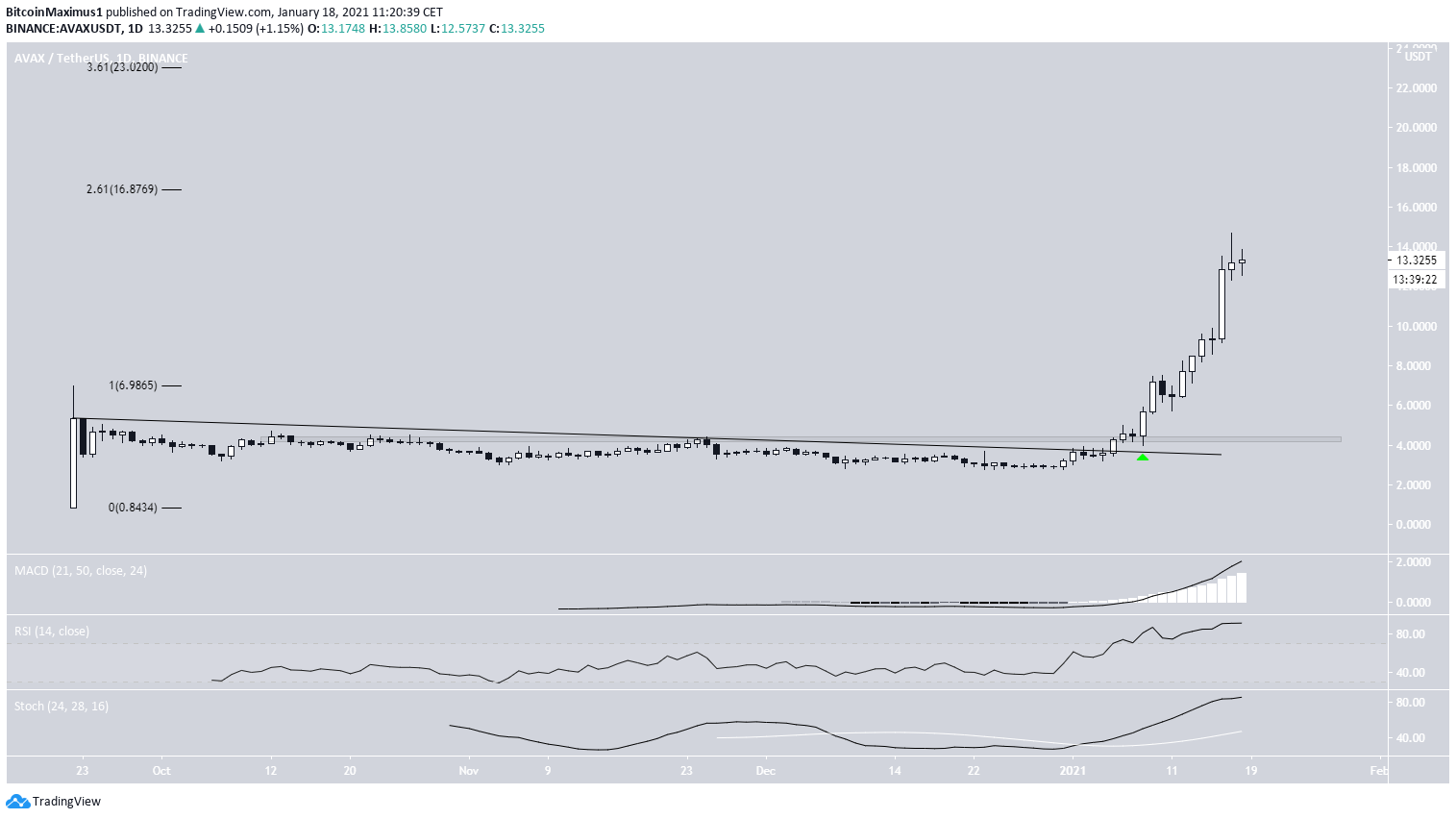

AVAX

AVAX has been increasing rapidly since breaking out from a descending resistance line and reclaiming a horizontal level on Jan. 8. Since then, the rate of increase has become parabolic.

Due to the lack of support below the current price, the rally seems a little unstable. Nevertheless, technical indicators are still bullish, supporting the continuation of the upward move.

Due to AVAX being at an all-time high, we need to use a Fib extension on the original upward move in order to determine the next resistance areas.

Doing so gives us the $16.87 and $23 levels as potential resistance areas (2.61 and 3.61 Fib extensions respectively).

For BeInCrypto’s latest Bitcoin (BTC) and altcoin analyses, click here!

Disclaimer: Altcoin trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Comments are closed.